When you think of a wealthy person, you normally think of owning a big house if you are from a Western nation. But in the Baltic states of Europe, a big TV shows your wealth, the bigger the TV, the more wealth you have. Meaning that we all have different perspectives on wealth.

Today we are often bombarded by videos on YouTube about how to make money and how the matrix is against you. You only have to hear it from a few people such as Alex Hormozi, Iman Gadzhi and other gurus out there. They all have one thing in common, they rarely give in detail while some lack real knowledge of their industry, spending their money on ads just to win a few clients.

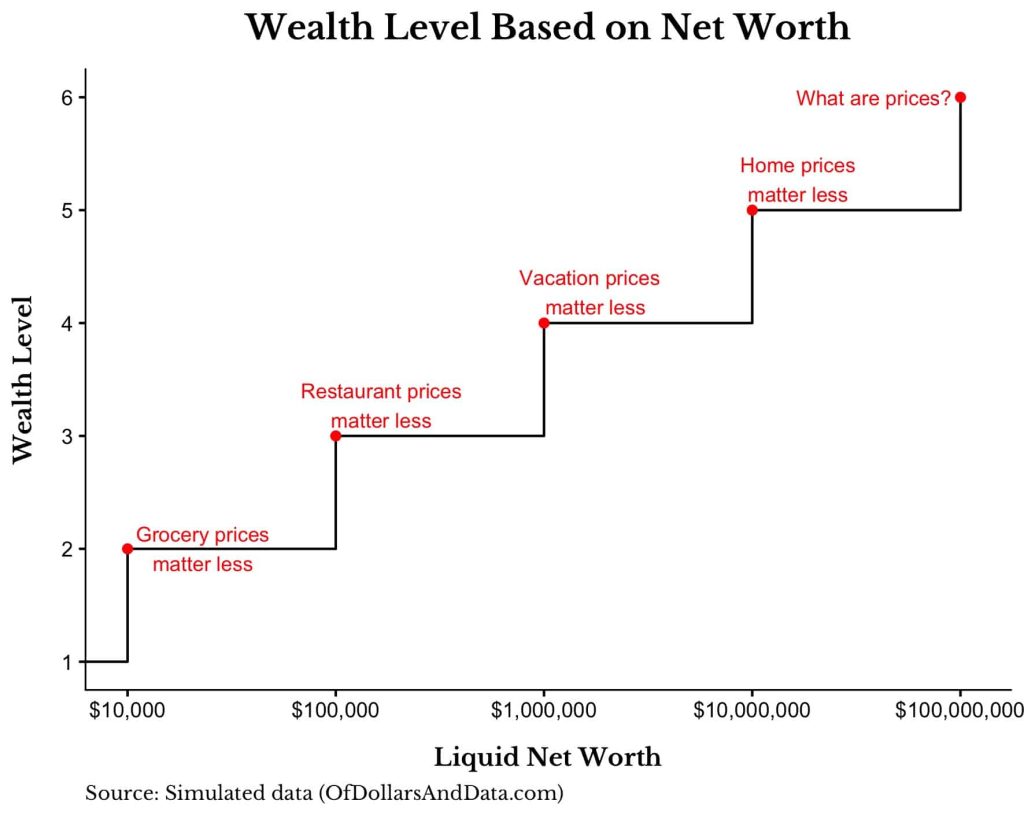

This shows that the struggle is real in what people believe wealth to be, even for the “gurus” themselves. So what is it? Well, there are 5-6 steps on the wealth ladder for you to be wealthy, in fact, it can be as little as 3 times your monthly salary saved in a savings account to be climbing this ladder. Ironically most poorest members of most of society focus sorely on living because there is very little to set aside each month to catapult themselves into a more wealthy category.

If you consider yourself living paycheck to paycheck, then ask yourself, did taking on debt in the form of credit cards or loans or a mortgage push you to your limit? If the answer is yes, then consider focusing on reducing your use of debt to less than 10% of your overall income. When you go past that mark, you’re more likely to be in distress with such a low income.

Thankfully I grasped this when I graduated from university, but work was never stable, one Christmas ill be debt-free and then snowed under. The sense of being able to spend again is too much of a temptation. That is why a lot of people today do “side hustles” and while most have done this they can be the key to unlocking your debt from being a stranglehold on you. These can be door dash, or even selling furniture from a lock-up storage just to bring in an extra hundred dollars a month.

Think about how you can reach to the point where you have 12 months’ salary saved in a bank account that is easy to access in less than 5 days. But not too easy that you can transfer it in a day and spend it all. For those kinds of emergencies like car breaking down, washing machines etc, aim to save between $2k-$3k.

If you reach 12 months worth of salary savings you are now in the top 5% of average Americans who have more wealth than the rest. The same also applies in Europe, the UK, Canada and Australia, but the amounts for the car are more typical. See this chart above, while it needs to be updated on the lower end of the scale because of increasing oil prices, it is affecting grocery and gasoline prices.

Join our wealth tribe newsletter!Check your Needs Vs Wants

Living within your means is a cornerstone of financial health. This principle involves spending less than you earn and avoiding debt for non-essential purchases. It requires discipline and a clear understanding of your financial limits.

One practical approach is to distinguish between needs and wants. Needs are essential for survival and well-being, such as housing, food, and healthcare. Wants, on the other hand, are non-essential items or services that enhance your lifestyle but are not necessary for your day-to-day living.

Good examples of needs are gas, toiletries, and basic food. So when you next pick your groceries, make sure artisan bread is not on your list, as it is a “want”.

Avoiding High-Interest Debt

High-interest debt, such as credit card debt, can quickly erode your financial stability. The interest rates on these debts can be exorbitant, leading to a cycle of debt that is difficult to escape. It’s essential to manage and minimize debt to maintain financial health.

If you have high-interest debt, prioritize paying it off as quickly as possible. Consider debt consolidation or refinancing options to lower your interest rates. Additionally, adopt a cash-based lifestyle to avoid accumulating new debt.

Setting Financial Goals

Setting clear and achievable financial goals is crucial for building wealth. These goals provide direction and motivation, helping you stay focused on your financial journey. Start by defining your short-term and long-term goals, such as saving for a down payment on a house, building an emergency fund, or planning for retirement.

Regularly review and adjust your goals as your financial situation changes. This ongoing assessment ensures that your goals remain relevant and attainable.

Increasing Income Through Side Hustles

In today’s economy, many people find that a single income source is insufficient to meet their financial goals. Side hustles or additional income streams can provide a significant boost to your finances. These can range from freelance work and part-time jobs to starting a small business or investing in the stock market.

When choosing a side hustle, consider your skills, interests, and available time. The goal is to find an activity that not only supplements your income but also aligns with your lifestyle and long-term goals.

Look below to join our newsletter for people who want to start side hustles.

Investing for the Future

While saving is essential, investing allows your money to grow over time. Investing in assets such as stocks, bonds, real estate, or mutual funds can provide higher returns than traditional savings accounts. However, it’s important to understand the risks involved and to invest wisely.

Educate yourself about different investment options and strategies. Consider seeking advice from a financial advisor to create a diversified portfolio that aligns with your risk tolerance and financial goals.

The Psychological Aspect of Wealth

Financial health is not just about numbers; it’s also about mindset. Developing a healthy relationship with money involves understanding your financial habits and behaviors. Emotional spending, financial anxiety, and a lack of financial literacy can all hinder your progress.

To improve your financial mindset, practice mindfulness and self-awareness in your spending habits. Set realistic and positive financial affirmations, and seek support from financial education resources or a mentor.

The Role of Financial Education

Financial education is a powerful tool in achieving wealth. Understanding basic financial principles, such as budgeting, saving, investing, and debt management, empowers you to make informed decisions. Unfortunately, many people lack this knowledge, leading to poor financial choices.

Seek out financial education through books, online courses, seminars, and workshops. Equip yourself with the knowledge needed to navigate the complexities of personal finance.

Building a Legacy

Building wealth is not just about securing your future; it’s also about creating a legacy for your loved ones. Estate planning, which includes creating a will, setting up trusts, and understanding inheritance laws, ensures that your wealth is transferred according to your wishes.

Consider how you want to impact future generations and plan accordingly. This might involve educating your children about financial responsibility, setting up college funds, or supporting charitable causes.

To learn more in-depth tips to build your wealth and join a worldwide entrepreneurial community, check out our newsletter below:

Join our wealth tribe newsletter!